Chase Sapphire Balance Transfer Limit

Everyday banking without fees.

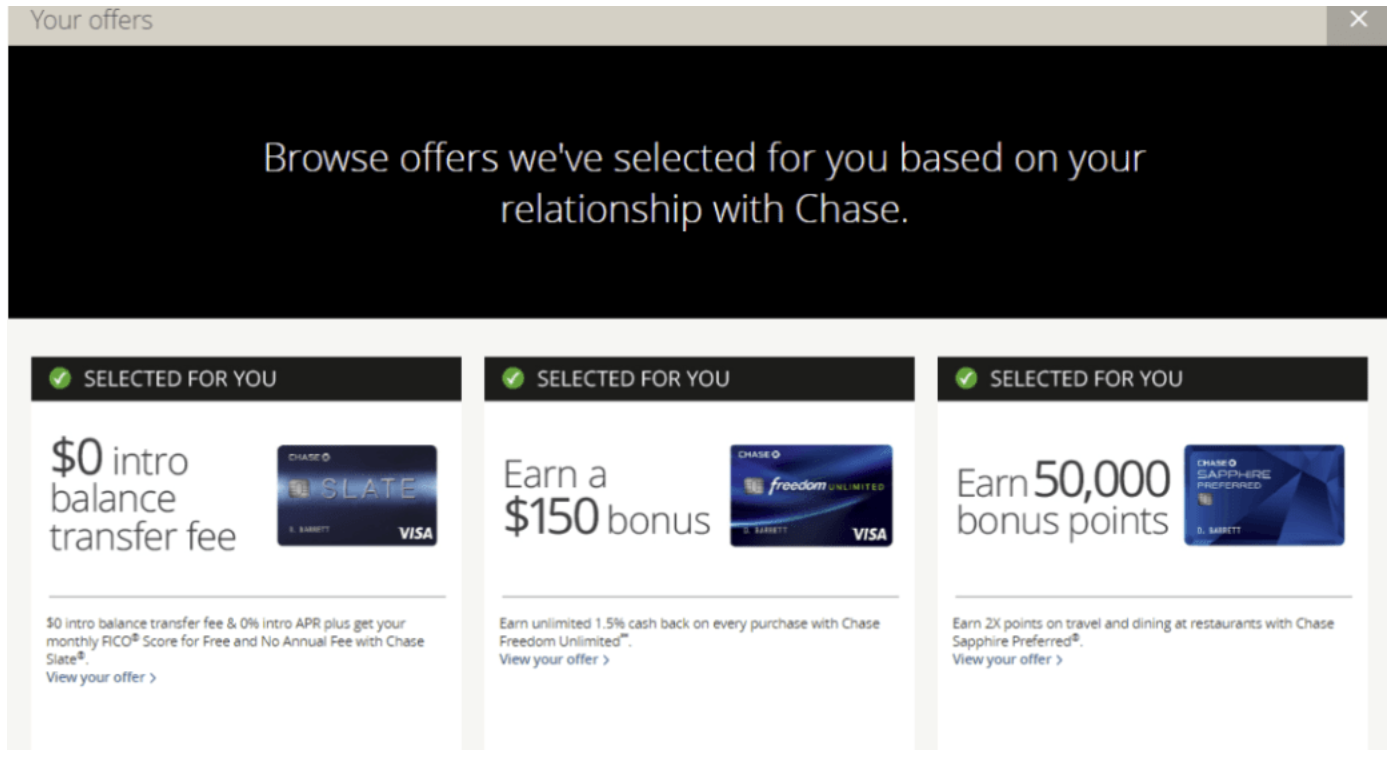

Chase sapphire balance transfer limit. The average credit limit for the preferred card is around 10 000. What can i use a balance transfer for. No chase foreign exchange rate adjustment fees on atm withdrawals or debit card purchases made outside the u s. Credit karma user data indicates the average chase sapphire preferred card cardholder has a limit around 10 000.

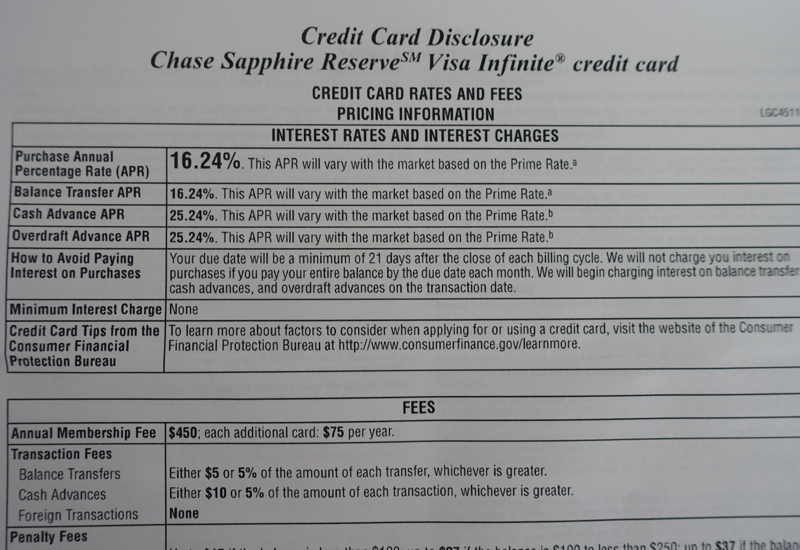

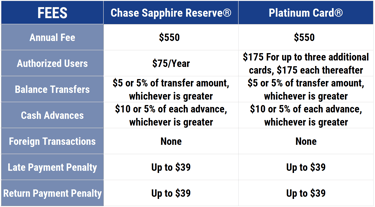

So if chase doesn t qualify you for at least a 10 000 credit line then you won t be approved for the card either. No atm fees worldwide 1 down the street or around the globe. Chase sapphire reserve credit limit. Most chase accounts have a 25 000 per day limit.

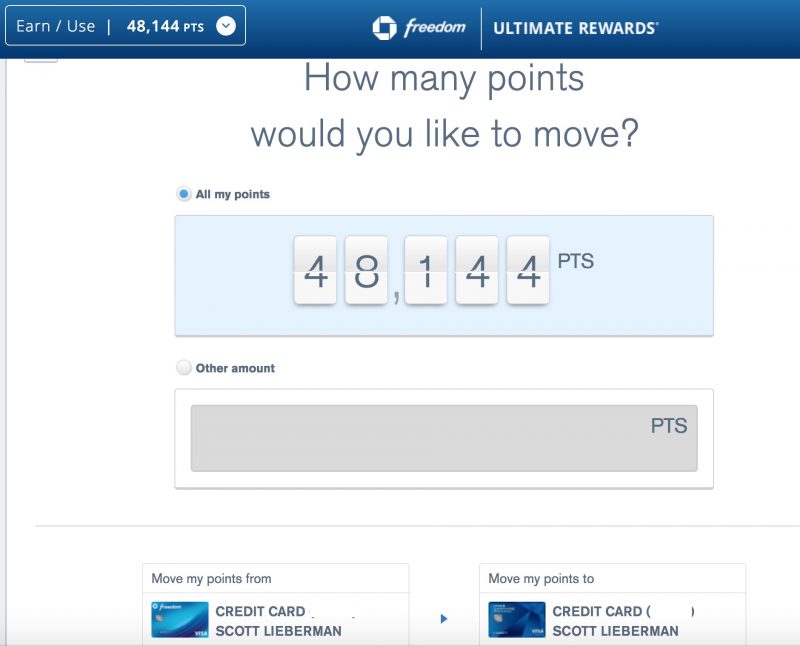

Higher atm and purchase limits with your sapphire banking debit card 5. That includes an initial bonus of 50 000 points after spending 4 000 in the first three months your account is open along with annual travel credits. Chase online lets you manage your chase accounts view statements monitor activity pay bills or transfer funds securely from one central place. Chase private client and chase sapphire banking limits are 100 000 per day.

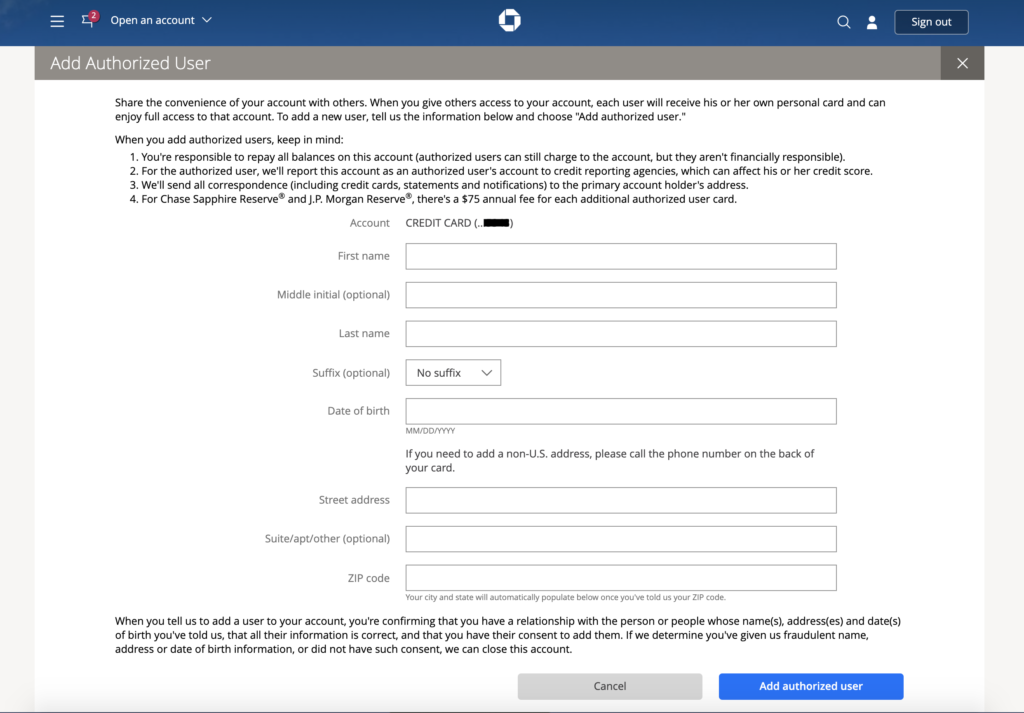

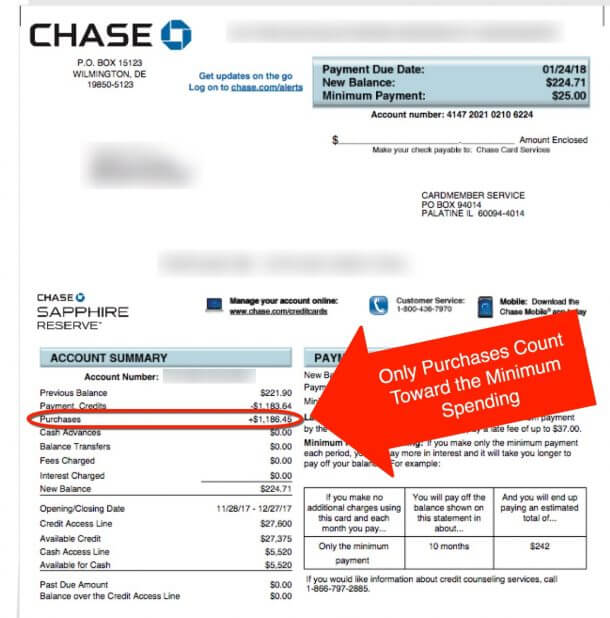

If you have questions or concerns please contact us through chase customer service or let us know about chase complaints and feedback. The chase sapphire reserve is a visa infinite card so the minimum credit limit is 10 000. Pay off higher rate credit cards. The chase sapphire reserve card offers a credit limit of 10 000 or higher according to its terms and conditions.

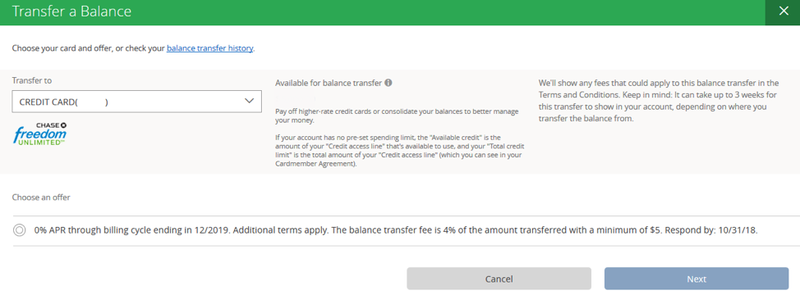

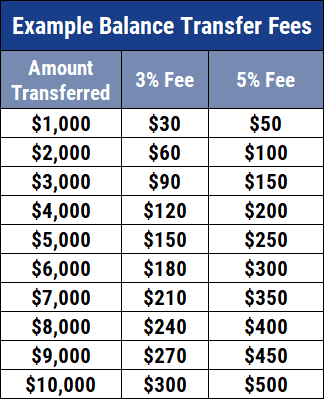

Keep in mind your other bank may have a different transfer limit. For transfers to from a non chase account it typically takes 1 2 business days to complete. Let s take a look at what kind of credit limit chase sapphire reserve offers. Pick which cards you want to pay down and then transfer the balance to your chase card with an eligible lower rate.

Compared to the reported credit limits of the chase freedom flex one of the bank s starter credit cards the chase sapphire preferred card has ten times as many high limit cardholders. It also gives cardholders a lot of different ways to save on travel and dining out. Pay for unexpected expenses or get cash. No wire transfer fees 6 or stop payment fees.

/chase-sapphire-preferred-d8cc6e87e5474245b576947076252332.jpg)