Chase Sapphire Reserve Foreign Exchange Fee

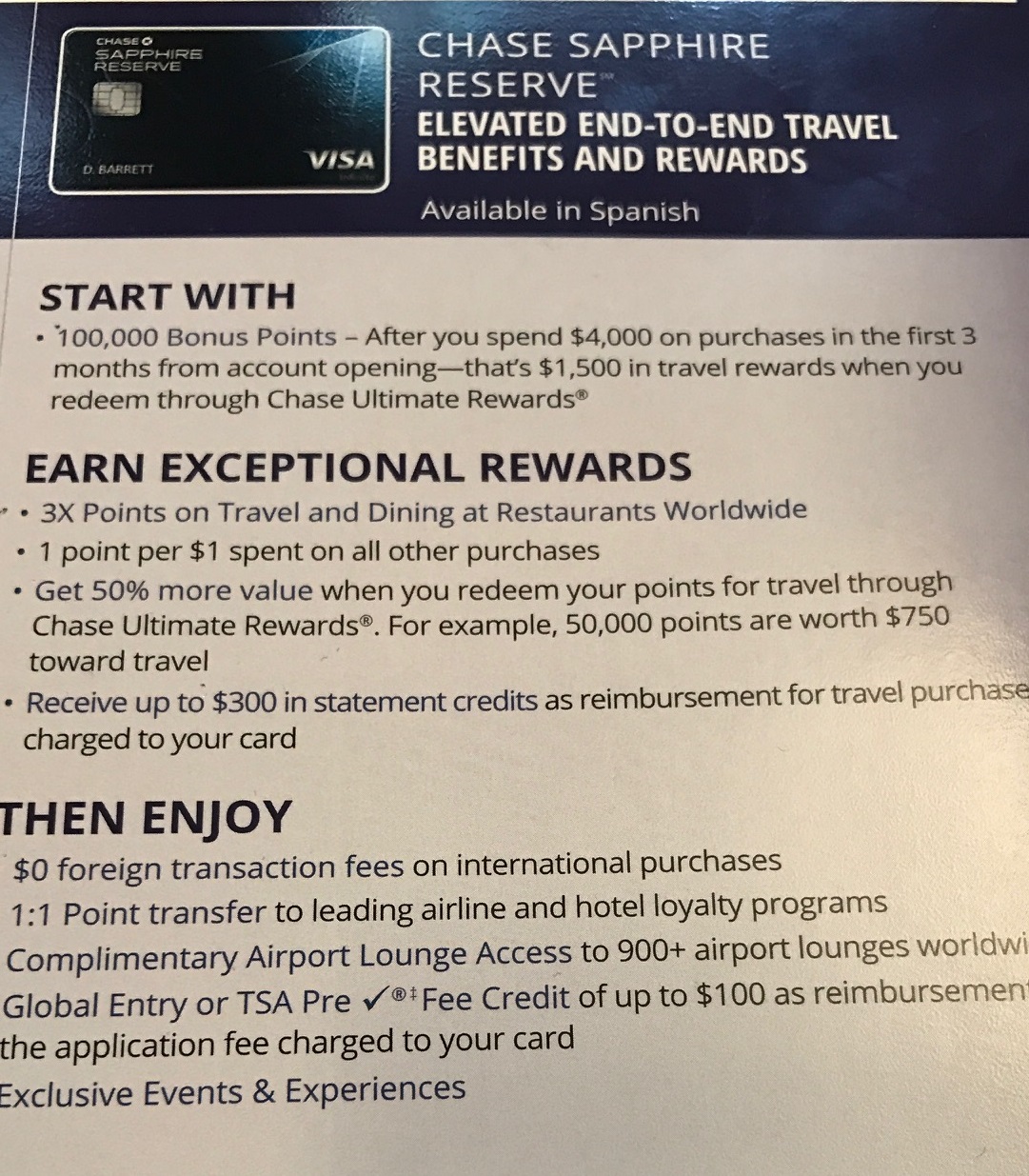

12 months of complimentary lyft pink membership.

Chase sapphire reserve foreign exchange fee. Chase sapphire reserve offers some of the best rewards great bonus and travel credits which makes it well worth the annual fee for those who travel regularly. Chase sapphire cards are popular choices for travelers as both chase sapphire preferred and reserve have 0 foreign transaction fee. Chase sapphire reserve. Travel with a no foreign transaction fee credit card from chase.

No foreign transaction fee. There is no foreign exchange rate adjustment fee when conducting transactions in a foreign currency. To offset the annual fee compared to what you would pay if your card had a 3 percent foreign transaction fee. Chase sapphire reserve.

The chase sapphire preferred card which is a top travel rewards card has a 95 annual fee. Use foreign currency exchange kiosks and atms which come with lower conversion rates and fees only as a last resort. Empty checkbox compare the chase sapphire reserve checkmark comparing the chase sapphire reserve 0 of 3 cards button disabled. Best no foreign transaction fee credit cards chase sapphire preferred.

And you won t be charged extra fees when using the citi prestige card abroad. Purchases made with these credit cards outside the u s. Chase sapphire foreign transaction fee. The sapphire preferred costs 95 per year while the sapphire reserve is 450 per year with a 75 fee for each authorized user.

Will not be subject to foreign transaction fees. Both offer bonus points extra points for travel and dining and premium travel benefits. Best for total value photo by the points guy annual fee. Chase sapphire preferred card.

There may not be a foreign transaction fee but whether your card is sapphire preferred or sapphire reserve there are other fees to remember. But by not paying foreign transaction fees you d only need to spend about 3 200 outside the u s. Dollars at either an atm or on a purchase foreign currency commissions and fees included in the exchange rate charged by third parties are excluded from. 60 000 bonus points after you spend 4 000 on purchases within the first three months of account opening worth 1 200 according to tpg valuations.

/chase_sapphire_reserve_FINAL-10928ca829154185a836f5ce7edd8183.png)