Chase Sapphire Reserve Foreign Exchange Rate

Exchange rates for top currencies.

Chase sapphire reserve foreign exchange rate. Along with the chase sapphire reserve chase cards like the chase sapphire preferred ink plus no longer available and chase hyatt do not charge a foreign transaction fee either. 15 99 to 22 99 variable based on your creditworthiness and other factors. Higher atm and purchase limits with your sapphire banking debit card 5. Save money and use a card that doesn t charge foreign transaction fees when you re traveling overseas.

And you won t be charged extra fees when using the citi prestige card abroad. No wire transfer fees 6 or stop payment fees. 15 99 to 22 99 variable based on your creditworthiness and other factors. The visa rate tends to be a relatively good value way to spend money internationally.

Mastercard usually has a small though occasionally quite significant advantage when it comes to foreign exchange rates. No atm fees worldwide 1 down the street or around the globe. 16 99 to 23 99 variable based on your creditworthiness and other factors. Everyday banking without fees.

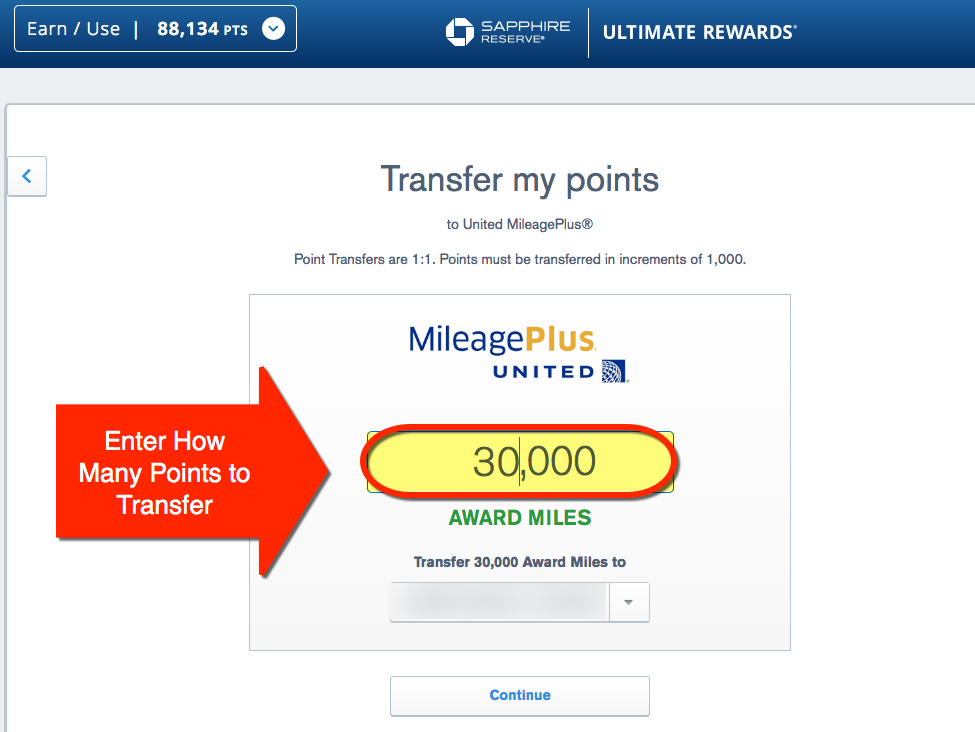

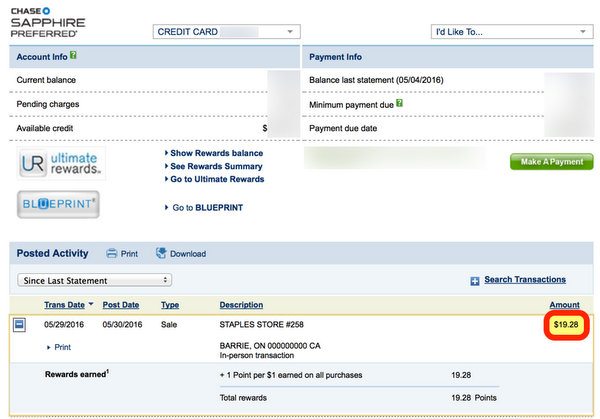

Chase sapphire preferred card chase sapphire reserve interest rates and fees. If you play with these two tools long enough you ll start to notice a pattern. Their rates are always better when you compare them with currency exchange companies such as travelex either online or at the airport. When you use a chase sapphire preferred or reserve credit card abroad your money will likely be converted at an exchange rate set by visa the card issuer.

Credit cards with no foreign transaction fees help you save money when traveling abroad. Visa offers its exchange rate calculator while mastercard makes its mastercard currency conversion tool available online. Rate review your card opens in the same window.

/chase_sapphire_reserve_FINAL-10928ca829154185a836f5ce7edd8183.png)