China Bank Lending Rate Floor

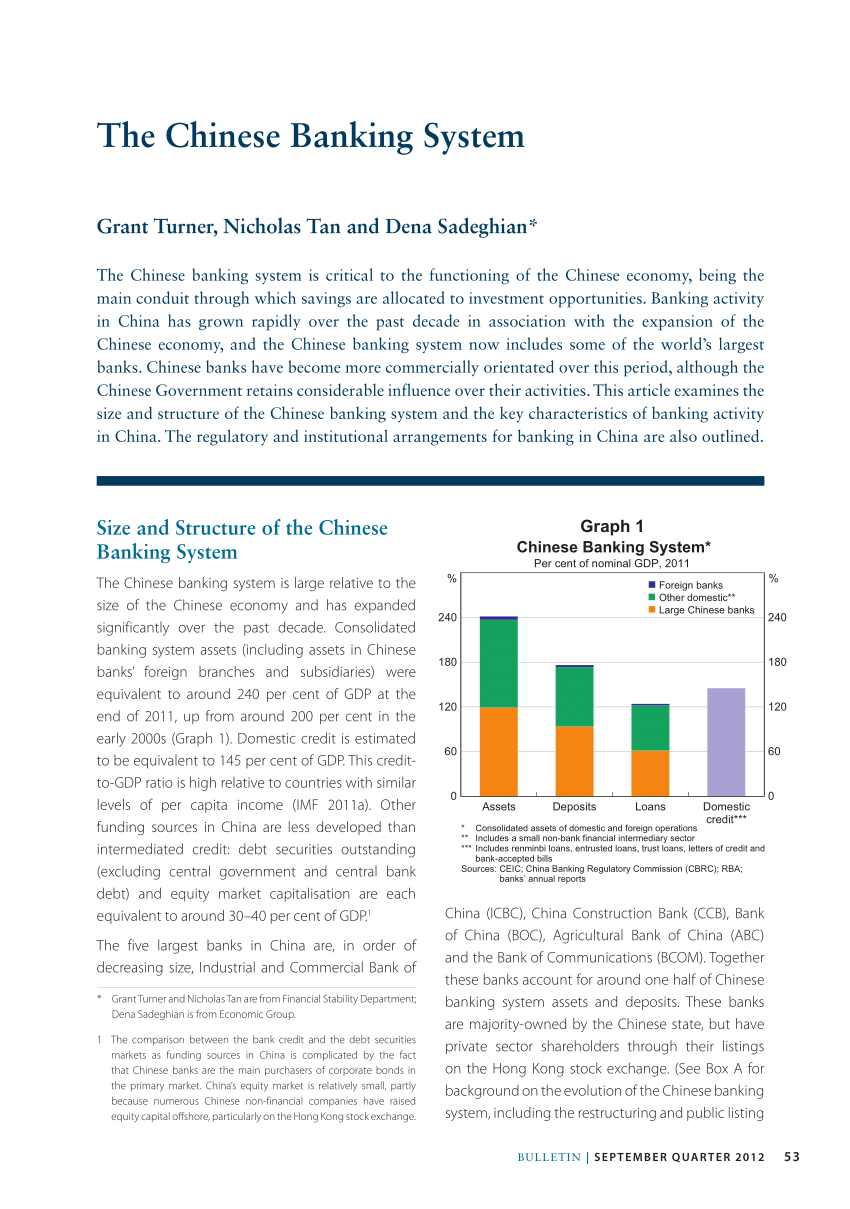

China has long kept a firm grip on lending and deposit interest.

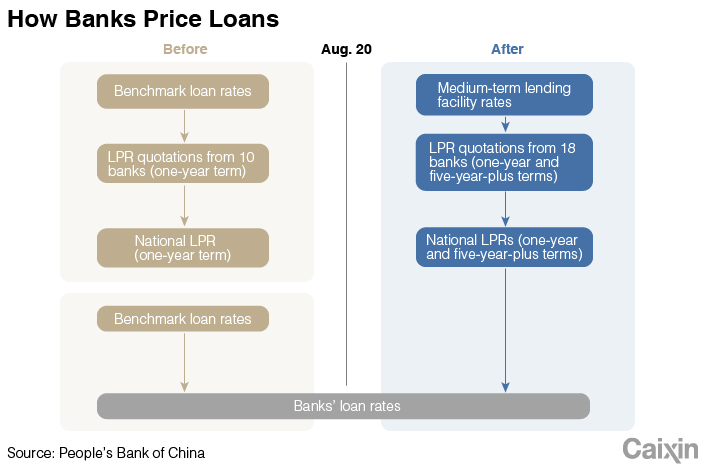

China bank lending rate floor. The rate is determined in part by another policy lever the medium term lending facility rate or mlf rate which serves as a floor for the new benchmark. Effective july 20 the people s bank of china pboc removed the lending rate floor previously set at 30 below the. An interest rate floor is an agreed upon rate in the lower range of rates associated with a floating rate loan product. China one year medium term lending facility rate was at 2 95 percent on friday october 2.

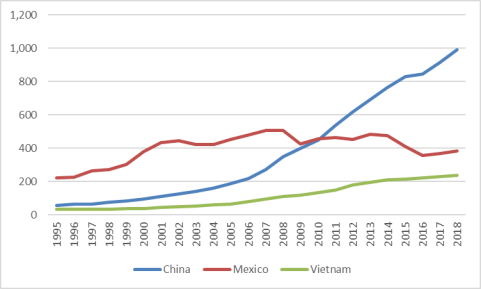

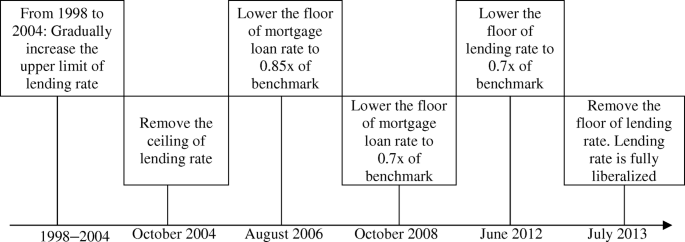

Effective from oct 8 banks will set mortgage loans based on the new loan prime rate. For first home buyers the mortgage rate floor will be the latest monthly loan prime rate lpr which was 4 85 per cent in august the people s bank of china said in a statement on sunday. By austin fraser 07 23 2013. Bank lending rate in china averaged 3 09 percent from 2016 until 2020 reaching an all time high of 3 30 percent in april of 2018 and a record low of 2 95 percent in april of 2020.

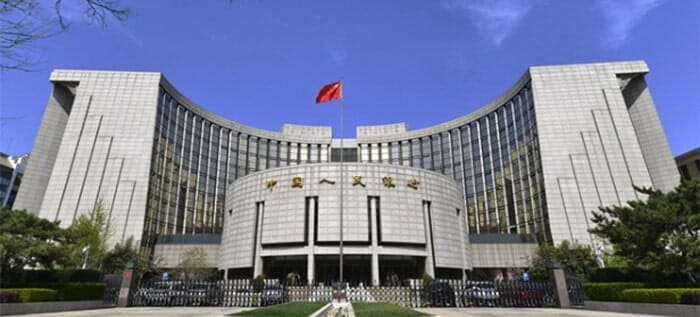

Interest rate floors are utilized in derivative. Tue aug 27 2019 5 50 am. This page provides china prime lending rate actual values historical data forecast chart statistics economic. The people s bank of china announced it will remove the floor on bank lending rates moving chinese rates one step closer to a market oriented system.

The resulting minimum rates are more or less the same as the actual lowest mortgage rates in china the central bank s said in another statement link in chinese said. China may scrap the official floor under banks lending rates as the first major step to liberalise its interest rate regime the official china securities journal reported on friday as regulators. It means that china has now ended controls on lending rates. In july the average mortgage rate for first home buyers in 35 large chinese cities was 5 44 according to data from research institution rong360.

China to set floor on mortgage rates to curb housing risks. Pboc s lending rate liberalization had little impact on cost of funding.